will advance child tax credit payments continue in 2022

January 13 2022 152 pm. Last December the CBO estimated that making the 2021 credit under ARPA and the TCJA permanent would cost 1597 trillion between 2022 and 2031.

Fourth Stimulus Checks The Push For Future Rounds Continues But Here Are Some Ways You May Receive Payments Pennlive Com

Tax Refund Schedule 2022 If You Claim Child Tax Credits.

. Within those returns are families who qualified for child tax credits CTC worth up to 3600 per child but you can still receive up to 2000 per child for 2022. Parents get the remaining child tax credit on their 2021 tax returns. This blog was updated on May 24 2022.

I have written detailed articles covering FAQs for this payment but the main one being asked now is whether or not families will continue to get paid monthly in 2022 starting. You will receive either 250 or 300. That includes the late payment of.

The monthly Child Tax Credit payments that were issued to millions of American families helped to reduce child poverty by more than 40 last year according to reports. As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there will be no advance payments offered to families. However if Congress doesnt approve President Bidens proposed modifications as part of the Build Back Better plan the.

The enhanced child tax credit including advance monthly payments will continue through 2022 according to a framework democrats released thursday. The Child Tax Credit is worth 3600 for children ages 5 and under and 3000 for children ages 6 through 17 at the end of. Its a mechanism for distributing the tax burden based on ability to pay.

The advance payments accounted for 50 of the credit you were due with the remainder and any adjustments to be claimed via your 2021 tax. The plan was always for another payment. Families who utilized the six monthly advance payments can expect to receive 1800 for each child age 5 and younger and 1500 for each child between the ages of 6 and 17 on their 2021.

To be eligible for the full child tax credit single parents must have a modified adjusted gross income under. However Congress had to vote to extend the payments past 2021. Those have all now been paid out but these six advance checks only accounted for half of the 2021 tax year Child Tax Credit payments.

The Child Tax Credit in 2022 isnt going away per se. Prior to 2021 the Child Tax Credit maxed out at 2000 per eligible dependent. The final half of the enhanced.

If no measure is taken the Child Tax Credit will revert to the pre-2021 Child Tax Credit where qualified families would be able to claim up to 2000 per qualifying child under. If you have a newborn child in December or adopt a child you can claim up to 3600 for that child when you file your taxes in 2022. But during the development of the child tax credit there was also a recommendation from the National.

This year the credit isnt gone. The maximum child tax credit amount will decrease in 2022 In. Heres an overview of what to know.

As a result of the american rescue act the child tax credit was expanded to. Rather its maximum value will simply return to 2000. The temporary expansions to the Child Tax Credit CTC dramatically reduced the share of children.

What are the advance Child Tax Credit payments. The JCT has made estimates that the TCJA changes. Therefore child tax credit payments will NOT continue in 2022.

The number of children living in poverty decreased by 40 when the monthly child tax credit payments were sent out from July to December 2021. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Unless Congress takes action the 2020 tax credit rules apply in 2022.

New Child Tax Credit Tool Makes It Easier To Sign Up For Payments Here S How Nextadvisor With Time

What To Know About The Child Tax Credit The New York Times

How To Claim A Missing Stimulus Check

Congress Failed To Extend Child Tax Credit Expansion But Murkowski Says She S Open To Negotiations

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

What Tax Preparers Need To Know About The Child Tax Credit Taxslayer Pro S Blog For Professional Tax Preparers

Justice At Work Pa Home Facebook

What To Know About The Child Tax Credit The New York Times

Fourth Stimulus Check Some Citizens Eligible For A Payment In April 2022 Marca

Child Tax Credit Deadline Missed Here S What Parents Need To Know

Tax Season What To Know If You Get Social Security Or Supplemental Security Incomesocial Security Matters

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

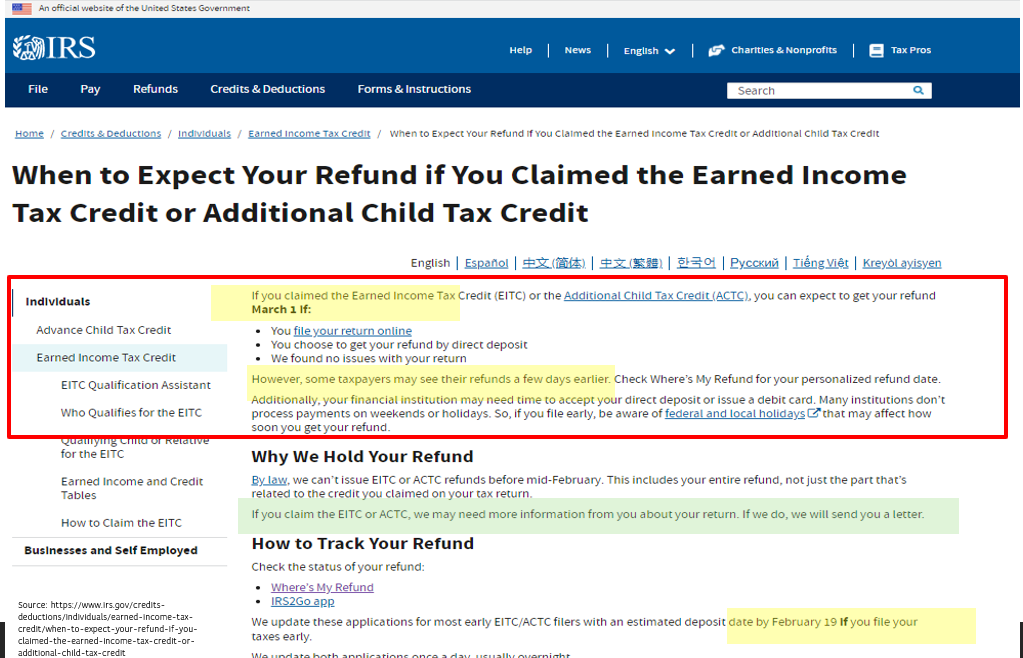

Path Irs Refund Payment Dates And Processing Delays For Tax Returns With Eic And Actc Payments Latest News And Updates Aving To Invest

What Tax Preparers Need To Know About The Child Tax Credit Taxslayer Pro S Blog For Professional Tax Preparers

Child Tax Credits Wait To File 2021 Taxes

Stimulus Update If You Had A Baby In 2021 You Can Get The Child Tax Credit Money Now Here S How

Child Tax Credit For U S Citizens Living Abroad H R Block

Things You Need To Know About Filing Taxes For 2021

Child Tax Credit Here S Why Your Payment Is Lower Than You Expected The Washington Post